Welcome to Equity Breakdown, where you will find short, no bullshit overviews of public companies! If you would like to receive it directly in your inbox, subscribe now!

To all the Equity Contrarians,

We are living in a golden age of massive technology disruption spanning from blockchain technology, genome sequencing, artificial intelligence, robotics, energy storage and the topic for today, 3D printing. The manufacturing industry is a $12.8 trillion monster that is prime for change. A new method is necessary that ensures domestic supply chains, custom designs of products at mass scale, and green production. 3D printing is now back on the radar to bring about this revolution and bridge the gap between design and production, empowering designers, and producing products with new architectures and less waste. There are many players who have existed in this space for a while but without the ability to achieve mass production. Today we will breakdown Desktop Metal, ($DM), a company that wants to revolutionize 3D printing by introducing mass-scale production.

Business Summary:

Desktop Metal is a manufacturing company that produces metal 3D printing systems. The company is leading the industry with additive manufacturing technologies with a focus on the production of end-use parts. Desktop Metal was created in 2015, by a team of renowned experts in materials science, mechanical engineering, and metallurgy to advance metal 3D printing to be faster, less complex, and affordable to be used in the most scalable fashion. The company delivers a solution that starts from product development to ultimately mass production across various industries, making it the first 3D company that is focused on volume production of end-use parts instead of just design and prototyping.

Technology Platforms: The company will aim to change the way parts of almost all materials are designed, manufactured, and sold around the world. They will accomplish this feat with key technology platforms:

Production System: first 3D printing system for mass production. The Single Pass Jetting technology makes it the fastest metal 3D printer in the world with the highest capacity. This is scheduled to ship in volume 2H 2021. The system ensures excellent part quality, competitive part costs, repeatability, and supports a variety of metals as inputs.

Studio System: is the world’s first office-friendly system designed to 3D print for the shop floor. Engineer teams can produce highly complex parts without leaving the office at 10x less cost than traditional metal 3D printers. The system uses Bound Metal Deposition and does not require lasers and powders. With power, internet connection, and CAD you will be producing immediately. The studio has been shipping in volume since Q4 2018. The key phrases to remember here are high-quality parts, easy to use, designed for the office.

Shop System: provides additive manufacturing to the machine shop market. Businesses can produce batches of complex, end-use metal parts. The system is easy to use and operate and ensure high productivity of 10x the speed legacy PBF additive manufacturing. Volume commercial shipments to begin in Q4 2020.

Fiber: first desktop 3D printer to produce high-resolution parts with “aerospace/industrial grade” fiber composite tape. Customers can print strong, stiff parts in a broad range of materials used in industrial Automated Fiber Placement ("AFP") processes. This is scheduled to ship in volume Q4 2020.

*Software is also a critical component streamlining the process of setting up to print.

*120+ patents issued or pending

The company’s mission is “to make 3D printing accessible to all Engineers, Designers, and Manufactures.”

Industry:

The global manufacturing industry is a $12 trillion behemoth (60% of US GDP). Currently, there are significant limitations in conventional machining methods. High upfront costs of tools/equipment, long lead times for design and production, design limitations, lack of customization, waste, and minimum order quantities to achieve cost efficiencies. 3D printing, or additive manufacturing, has emerged as the solution. The following benefits stem from the use of 3D printing:

Design flexibility

Assembly consolidation

Supply chain evolutions

Sustainability

Mass customization

End-use production

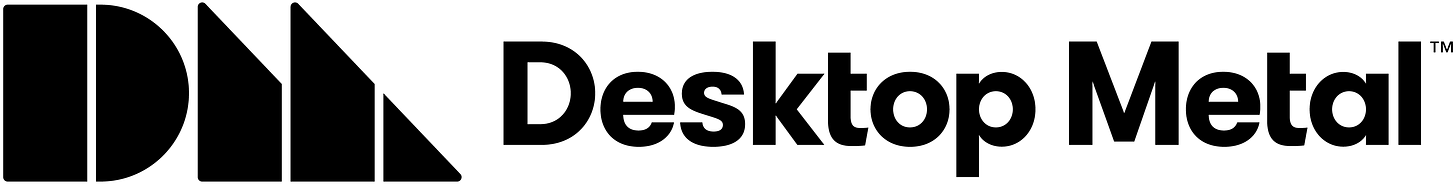

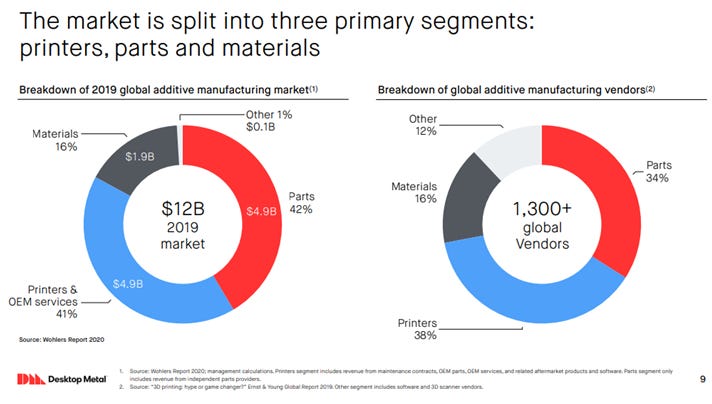

According to research from ARK, 3D printing will revolutionize manufacturing, growing to $97 billion in 2024 at an average annual rate of 65%. In its infancy, 3D printing 1.0 was focused on design and prototyping which lacked scale. Now, 3D printing 2.0 has emerged with its primary focus on mass production and end-use parts. According to E&Y global survey, 83% of industrial businesses planning to apply 3D printing technologies which resulted in a spending boom that has doubled from $6 billion to $12 billion from 2016 – 2019.

Market Opportunity:

Desktop Metal is positioned to lead the industry in deploying 3D technologies for scalable, end-use production. The company provides easy-to-use, high-quality, integrated manufacturing solutions built on hardware, software, materials, and services. The legacy 3D technologies have reached high penetration in the $12.5 billion prototype market. Desktop Metal has a TAM of $490 billion with growth expected to transform from $12 billion in 2019 to $146 billion by 2030.

Business Model Landscape:

Desktop Metal generates revenue from the sales of their products. Studio Systems was their first product that was shipped in Q4 of 2018. To date, the company has generated 86% of the revenue from selling Studio System with consumables such as metallic/ceramic materials and 14% from software and support services. The company is in the late stages of developing the three additional 3D systems which have already been installed in early customers.

Desktop Metal markets and sells 3D solutions through a global distribution network. The team is heavily resourced towards product development and as a result majority of revenue results through sales to resellers, who in return resell the company’s products and provide services to the customers.

The following customer landscape is created through Desktop Metal’s platform:

Primary customers are global distribution network of 80 resellers experienced in the 3D space and across 60 countries

Customers range from automotive, aerospace, healthcare, consumer products, heavy industry, and machine design. No single customer accounts for more than 10% of revenue.

BMW and Ford have provided strategic investments

Adidas, Bosch, Google, U.S. Army, Lockheed Martin, StanleyBlack&Decker

89% of the revenue is generated in North America and Europe.

Competitive Strengths (Moats):

Desktop Metal has classified a series of core strengths to dominate the additive manufacturing space:

Technology Platform: The company has three core key print process innovations that are unique to the market:

Single Pass Jetting | Bound Metal Deposition | Micro Automated Fiber Placement

The company has developed proprietary sintering technology, which means to compact and form solid objects, with software to make strong end-use products in an office setting.

Team: The team is founder-led with the majority being engineers in mechanical engineering, materials science, software, robotics, and industrial design. More than 25 employees hold PhDs.

Global Distribution Network: The network of resellers is global with vast experience across digital modeling and 3D printing. The network brings an existing base of customers and supports all commercial functions to generate revenue.

Diverse Product Portfolio: The company provides four system solutions that are defensible and difficult to replicate. The company offers office-friendly, entry-level, low-volume production of metal parts to industrial, high-end mass production.

Printer Speeds & Turnkey Solutions: Production system can achieve speeds of 12,000 cubic centimeters per hour allowing customers to print millions of parts per year. More importantly, the company also maintains consistency and accuracy. Additionally, with software and a special furnace, it enables customers with minimal 3D printing experience or materials expertise to process complex metal parts entirely in-house without third-party equipment required.

Green Manufacturing: The company delivers mass-scale production with near-zero waste. The vast majority of metal is transformed into parts and the powder produced is reusable.

Competition/Risks:

The company has highlighted certain competitive and operational risks that may affect its performance.

Competition: Desktop Metal is active in the metal filament space and binder jetting space.

Metal Filament Space: BASF, Apium, Triditive

Binder Jetting: HP, Stratasys, Digital Metal, 3DEO, ExOne

HP has metal 3D printing systems in development, likely to be a binder jetting system

Business Model dependence on recurring revenue: Purchasing input metal materials or related service contracts to be incorporated in the future 3D printing systems orders is essential. Customers are sensitive to pricing and demand needs to continue for the Production systems which directly impact the input metal materials.

Dependence on Network of resellers: Company does not have channels that directly sell to end-customers. Heavy dependence on the 80 sellers places the commercial efforts at heavy risk.

Reservations for the Production System may not convert to orders: There are currently 90+ reservations with shipment visibility through the first half of 2024E. The current economic climate created by Covid and price points does create risk with customers’ ability to follow through on purchases. The Production system is necessary for mass production.

Team:

The company is still founder based and is composed of the following key members:

Ric Fulop, Founder, and CEO: Prior, Fulop was GP at North Bridge Venture Partners and Founder of A123 Systems, Inc., Boston’s largest IPO and one of the largest automotive lithium-ion suppliers

Steve Billow, President: Prior, Billow served as VP and CTO of Inkjet Solution of Electronics

Jonah Myerberg, Co-Founder and CTO: Prior, Myerberg served as Director of Technology for A123 Systems.

Leo Hindrey, Jr., Chariman and CEO of Trine Acquisition Group: Hindrey is an accomplished leader and investor. He has served as CEO of AT&T Broadband, CEO of GlobalCenter Inc, and CEO of the YES Network, and recognized as one of the cable industry’s “25 most influential executives”.

6 Co-Founders (4/6 – MIT Professors)

Existing DM shareholders will retain 74% of the company with SPAC trust shares at 12%,Founder shares at 2%, and Pipe Equity at 11%.

Financial Performance:

The company post-merger with TRNE will have an implied Enterprise Value of $1.8 billion representing 1.90x 2025 revenue.

The company has achieved $26.4 million in revenue for the year 2019, a (2,457%) increases over the $1.0 million earned in 2018. This instant increase is a direct benefit from a full year of product shipment. More recently the company earned $5.5million in six months ended 06/30/20 resulting in a (-54%) YOY from $12.1 million. The drop in sales in 2020 was related to the Covid economic shutdown. However, the company is expected to hit $15-$25 million in 2020 and $941 million by 2025.

As of 12/31/2019, and 2018, the company’s net losses were $103.6 million and $121.4 million. Gross margins for the business as of 2019 are -$24.4 million. The company is expected to achieve positive gross margins by 2021 of $19.8 million (25.6%) and $508 million ( 54%) by 2025.

The business is asset-light with completed manufacturing and systems ready for delivery. Reservations amounting to ~$500M of revenue is scheduled in the span of five years.

Post-transaction the company will be equipped with $625 million of cash and $9.9 million in debt.

The company provides the following forecasts:

Revenue - 2025E: $941.5M (211.6% CAGR)

Gross Profit – 2025E: $508.3M (54.0%)

Adj EBITDA – 2025E: $268.2M (28.5% margin)

Free Cash Flow – 2025E: $230.5M (200% CAGR)

EV / Revenue – 2025E: 1.9x

Desktop Metal plans to continue growth through the following strategies:

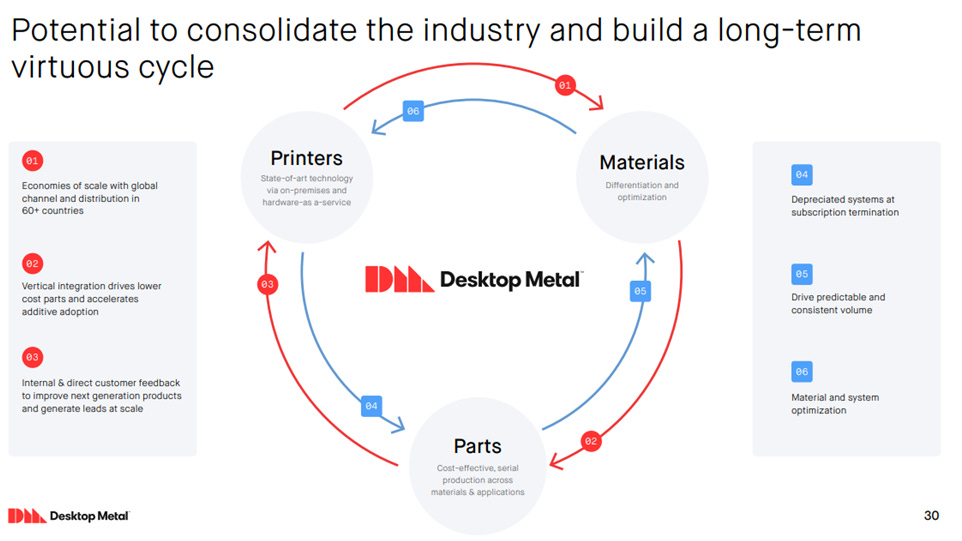

Strategic Acquisitions: The company is equipped with cash to accelerate market penetration and build a long virtuous cycle between parts, materials, and printers. This will help achieve vertical integration.

10+ opportunities in contract

60+ opportunities ~$2B revenue opportunity identified

Expand service related to parts: The company intends to manufacture parts for sale to customers. This will allow customers with low CAPEX abilities to purchase parts before fully integrating in-house production through the platform systems Desktop Metal offers.

Extend distribution channels: The company will increase its direct sales efforts to expand its footprint with Fortune 500 companies. The majority of the networks are focused on North America and Europe. Currently, the company is generating only 11% revenue in Asia-Pacific, with strong opportunities in the Middle East and Africa.

-Igli

You can access and download the detailed report which will include the summary and a company info-graphic for your records.

If you like the content please make sure to share this newsletter, share this post, or subscribe (if you have not already)!

Additional resources for all the Equity Contrarians (Leeeetttsss Gooooooo!!!)

Desktop Metal One Page Infographic

Desktop Metal Company Filings

Desktop Metal Chamath Palihapitiya One Page Memo

Desktop Metal Investor Conference Call Transcript 08.26.2020

Desktop Metal Investor Presentation

Desktop Metal Timeline Achievements

NewsThink 3D Printing Industry Video

Desktop Metal Virtual Tour

Desktop Metal ($TRNE - $DM) Breakdown