Hi Everyone,

It’s time for a change in the financial world ruled by suited bankers and plagued by antiquated systems and operations. 'Disruption' in financial services is currently on overdrive. Consumers and businesses expect effortless, secure, and scalable finance services ranging from the entire payment life cycle, personal financial management, and access to capital. Today we will breakdown Square (SQ), the company that aims to allow businesses and individual consumers to participate in the economy and reap the benefits of fintech services across its cohesive ecosystem.

Business Summary:

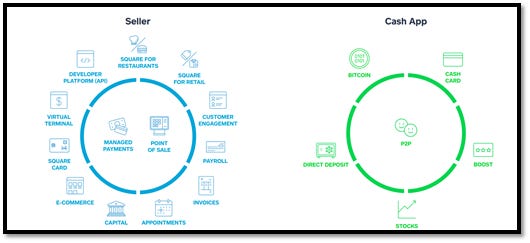

Square was founded in 2009 as a financial technology company aimed to enable businesses (sellers) to accept credit card payments. Initially, Square was solving payment processing problems experienced by small businesses. Since then the company has continued with innovation in technology and currently offers more than 30 distinct products and services. The 30 products funnel two ecosystems:

The seller ecosystem offers businesses a combination of software, hardware, and financial services to help start, run, and grow. It has removed fragmented offerings and weaved all the services together into a cohesive commerce ecosystem.

The cash ecosystem provides customers with financial products and services through Cash App. Individuals can quickly store, send, receive, spend, and invest their money.

Technology Features: The company delivers the following technology capabilities:

Software: Suite of cloud-based software solutions that focus on efficient operations. Point of sale products allow sellers to ring up sales, send digital receipts, and receive instant customer feedback. The features integrate payments, sales tracking, inventory management, customer purchase history, and business management capabilities

Hardware: Custom designed hardware that processes all major credit cards. The portfolio consists of a magstripe reader, contactless and chip reader, square stand, square register, and square terminal. The tools provide a comprehensive point-of-sale solution

Financial Services: The company offers services that manage payments, instantly transfer funds, square card to facilitate spending and managing of funds, square capital to offer loans, and payroll features to hire, onboard, pay, and manage taxes and employee benefits

Cash App: The ecosystem offers customers peer-to-peer transfer of money, cash card to spend money, and investing opportunities in equities and more recently the ability to buy and sell Bitcoin

The company’s mission is to, “ensure that no one is left out of the economy because the cost is too great or the technology too complex.”

Industry:

Technology is penetrating the finance industry introducing digitization and decentralization. For years, the industry has remained heavily regulated with outdated practices and plagued by inefficient infrastructure and legacy technology. Consumers and businesses specifically small and medium-sized businesses, however, are craving efficient participation in the economy. They have resorted to financing technology features that aim to breakdown barriers and offer integrated seamless solutions regarding the transaction of money. According to the Global Fintech Adoption survey in 2019, a whopping 96% of the respondents are aware of at least one fintech service, and 75% have used at least a product, app, or service relating to the transfer of money. Disruptions in the industry are happening across the following categories:

Banking/Insurance

Transaction and payment services

Mobile wallet payments

Blockchain/Bitcoin

Wealth-management/personal finance

Market Opportunity:

Square has divided the market among sellers and individual customers based on their core ecosystems.

Seller Ecosystem TAM: $85-$100 billion (3% market share):

Transaction Profit: $39B | Software: $30B | Square Capital: $12B | Financial Services $5B

Cash Ecosystem TAM: $60 billion (2% market share):

Sending: $20B | Spending: $41B | Investing: $2B

Business Model Landscape:

The company’s revenue is primarily generated through four key streams:

Transaction-based revenue (65% of revenue): Sellers are charged a transaction fee that is calculated based on a percentage of the total transaction amount processed

Subscription and service-based revenue (22% of revenue): revenue from cash app, square capital, and instant transfers

Hardware Revenue (2% of revenue): revenue from sales of chip readers, square stand, register, and terminals

Bitcoin Revenue (11% of revenue): revenue is recognized when customer’s purchase bitcoin

The company continues to see greater growth through Cash App which mainly contributes to its subscription revenue stream. Additionally, Bitcoin revenue has increased by 550% amounting to $1.1 billion six months ending 06.30.20 due to growth in bitcoin users and customer demand.

The following customer landscape is present for Square:

Seller Ecosystem:

The company processed $106.2 billion of gross payment volume (total dollar amount of all card payments processed) which was generated from $2.3 billion card payments

Point of sale ecosystem had 180 million buyer profiles in 2019

55% of the total GPV was driven by large sellers who generate more than $125 thousand in annualized GPV

No customer accounted for greater than 10% of gross payment volume or total net revenue

In Q2 2020, GPV from online channels was up 50% and made up more than 25% of the Seller GPV. One in three online stores onboarded in the second quarter were new to Square

Cash Ecosystem:

30 million active customers who had at least one cash inflow or outflow

Cash app customers who use two or more products generated 2x to 3x more revenue

In Q2 2020, Cash App customers transacted more than 15x per month on average

Cash card users have been at 7 million (2x growth from last year)

Direct deposits were the most engaged cash card users and spent 2x to 3x more than other cash card activities

In Q2 2020, Cash App customers have more than $1.7 billion in cash balances stored in their accounts

Competitive Strengths (Moats):

The company aims to create a cohesive ecosystem that manages and grows business while simultaneously helping individuals manage their money. According to SEC filings, Square has the following advantages:

Strong Network Effects: Cash App has more than 30 million active customers transacting 15x per month

Efficient Customer Acquisition: Low acquisition costs contributed by the peer-to-peer payments, seamless onboarding, and trustworthy brand

Technology and Design Platform: Platform is integrated end-to-end encompassing hardware, software and data. The full service helps businesses manage the entire payment life cycle

Omni-Channel Capabilities: High NPS score of 63 regarding the brand, 14,000 retail stores with hardware products, third-party developers, and direct and scalable online marketing solutions all contribute to the diverse expansion of Square

Founder based team: Square is led by one of the best CEOs and Founders known as Jack Dorsey. He is also the CEO of Twitter. The company has exceptional talent and focuses on consistent innovation and re-inventing their ecosystems

Two complementary ecosystems: Square offers Square capital, Weebly, and Cash App holistically with all the other services. The company can drive traffic from customers using Cash App to its seller ecosystem

Competition/Risks:

The company has highlighted certain competitive and operational risks that may affect its performance.

Competition: The company’s main competitors are Paypal (iZettle, and Venmo), Stripe, Tencent Holdings, Shopify, and Clover

Majority of revenue driven by one source: Company is dependent on payment services from businesses. While the company has four revenue streams, additional innovation needs to occur where all their cost centers are converted into revenue streams.

Increased competition: Customer needs are changing with rapid technological change. In 2019, Apple introduced the Apple Card, which was not traditionally in payment services. Pricing pressures and stronger brand recognition from competitors like PayPal will put pressure

Regulation: Company is heavily dependent on privacy and banking/lending restrictions. The recent involvement in Bitcoin also poses potential risks as it is not considered a legal tender and regulation is currently evolving

Liquidity Control: The company holds $2 billion of the principal amount of convertible senior notes as of 06/30/2020 that mature by 2023. As the company grows and lacks profitability it relies heavily on debt and equity financing.

Team:

The company is lead by the original founder and is composed of a team specialized in the fintech environment:

Jack Dorsey, CEO: Jack is CEO and chairman of Square and CEO of Twitter. He co-founded both companies and actively oversees both companies.

Brian Grassadonia, Cash App Lead: Brian has held numerous positions in Square including launching the company’s credit card reader.

Alyssa Henry, Seller Lead: Alyssa leads PM, design, and engineering for the seller facing products. She previously served as VP of Amazon Web Services.

Jacqueline Reses, Square Capital Lead: Jackie oversees banking and lending products. She previously served as Yahoo’s Chief Development Officer and was on the board of Alibaba Group.

Morgan Stanley, Vanguard Group, Fidelity Management, BlackRock, and Wellington are the top five owners of the company’s shares.

Financial Performance:

The company is trading at $171.02 resulting in a market cap of $75.8 billion.

The company has achieved $4.7 billion in revenue for the fiscal year ending 12/31/2019, a 43% increase over the $3.2 billion earned in the fiscal year 2018. More recently the company earned $3.3 billion in revenue for six months ended 06/30/2020, a 55% increase over $2.1 billion earned in the same timeframe 2019.

As of 06/30/2020, the company had $48.5 billion in gross payment volume versus $49.3 billion in 2019. The 1.6% drop was driven by Covid related activities specifically for their seller ecosystem involving payment services. Additionally, it’s important to note that the cash app was a primary driver for the growth experienced in 2020. In the second quarter, Cash App generated $1.2 billion of revenue and $281 million of gross profit.

As of FY 2019 and 2018, the company earned a net income of $375 million and a net loss of -$38.4 million. Gross Margins as of 06/30/2020 for the seller ecosystem was around ~42.5% and cash app ecosystem ~26.8%.

The company has also generated AEBITDA income of $83.2 million resulting in an AEBITDA margin of ~1.7% and 505.6% YoY growth.

Square’s current market value is 12.8x its 2020 LTM revenue.

Square plans to continue growth through the following strategies:

1. Seller Ecosystem growth:

$16B transaction profit opportunity in international markets

New product and use cases

New markets focusing on large sellers ($20M-$100M+ in size)

2. Cash Ecosystem growth in a $9 trillion market:

New products and use cases focusing on cryptocurrencies (Bitcoin).

purchased 4,709 bitcoin amount to $50 million

Expansion in international markets in Africa

-Igli

You can access and download the detailed report here which will include the summary and a company info-graphic. If you like the content please make sure to share this newsletter, share this post, or subscribe (if you have not already)!

Square Inc. (SQ) Breakdown